How to Read a Pay Stub

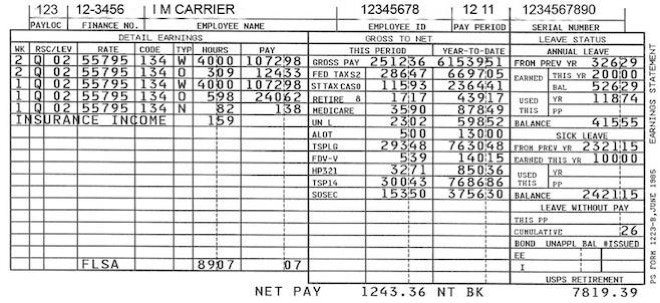

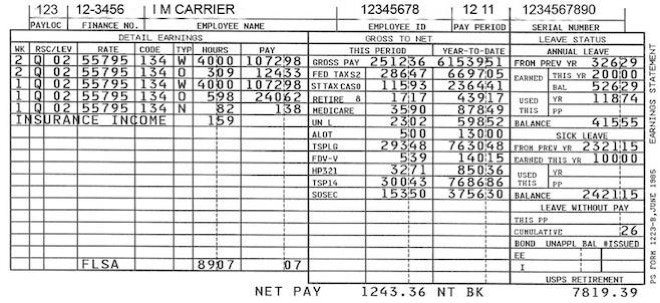

PAYLOC

Your pay location code indicates where you are assigned to work.

FINANCE NO

Finance number for the facility that you work in.

EMPLOYEE NAME

Your name.

EMPLOYEE ID

Your 8-digit employee ID number, instituted in pay period 14 of 2003, replaces the employee Social Security number previously used, to help strengthen privacy concerns.

PAY PERIOD

This is the pay period and year in which you receive the payments (PP-YR or 01-00). Each calendar year is separated by twenty six (26) pay periods of two (2) weeks each.

SERIAL NUMBER

This is either the serial number of the check issued to the employee or the sequence number of the "Form 1223" earnings issued when the employee's net pay has been directly deposited to the financial institution of their choice.

DETAIL EARNINGS

This is the general heading for all of the columns which identify the type and number of hours you are being compensated for, the week in which those hours occurred, the rate schedule and level, the designation/activity code, and the gross payment amount for the period.

WK This specifies the week, either 1 or 2, of the pay period in which the hours were worked. If an adjustment is being made, the week that the adjustment is made for will be printed on that line.

• RSC This is the Rate Schedule Code for the hours stated. Q - City Carrier.

• LEV This is the Grade Level for the hours stated. 01 - City Carrier, 02 - Carrier Tech (T-6).

• RATE This the Base rate (annual or hourly), including the cost-of-living allowance (COLA) for the hours stated.

• CODE This is the employee's Designation/Activity code. For a Regular Carrier, the code would be 134. For a PTF Carrier, the code would be 434.

• TYP This is the Type of Hours code. Codes include:

• W Straight work hours

• O Overtime hours

• L Leave hours (either paid leave or leave without pay)

• N Night differential hours (for hours worked between 6:00 PM & 6:00 AM)

• V Penalty overtime hours

• P Out-of-Schedule Premium

• H Holiday work hours

• S Sunday Premium

• G Guaranteed time or guaranteed overtime hours

• HOURS This space will show the actual hours and hundredths worked for every hours type listed.

• PAY This space will show the total gross pay for each type of hours worked.

• INSURANCE INCOME - Premiums paid by an employer for employee life insurance coverage in excess of $50,000 are subject to income tax as imputed income. The imputed income is calculated using an Internal Revenue Service formula. Tax is not withheld from this imputed income during the course of the year, but imputed income is included in the employee’s gross income at the end of the year and is printed on Form W-2. The earnings statement will show this imputed income as INSURANCE INCOME and the hours in the block 14 section.

• FLSA The Fair Labor Standards Act is a Federal Statute of general application that establishes requirements for child labor, minimum wages, equal pay, and overtime pay. FLSA work hours and FLSA overtime pay is printed on the Form 1223 whenever work hours for one or both weeks of the pay period exceeds forty (40) hours for nonexempt employees.

•

GROSS TO NET

This is the general heading for the two columns which show the total gross pay, all deductions,

and the resulting net pay for the current pay period and the pay year-to-date.

• GROSS PAY This is the gross pay for this pay period and the year-to-date, including COLA.

• FED TAX This is the amount deducted for federal tax this period and year-to-date. Your claimed marital status and number of exemptions will appear next to FED TAX. M2 would mean married with two exemptions. S0 would mean single with no exemptions.

• ST TAX This is the amount deducted for state tax this period and year-to-date. Again, your claimed marital status and number of exemptions for the state will appear next to ST TAX. CAO1 would indicate the taxes were withheld to the State of California for a person married claiming one exemption.

• RETIRE --This is the amount deducted toward your retirement account for the pay period and the year-to-date.

• 1 CSRS - Civil Service Retirement System

• 2 FICA - Federal Insurance Contribution Act

• 5 CSRS Offset - A combination of Civil Service Retirement and Federal Insurance Contribution

• 8 FERS - The Federal Employees Retirement System covers all career employees first hired on or after January 1, 1984.

• A FERS (elected) - those CSRS employees who chose to convert to FERS.

•

• MEDICARE Federal Insurance Contribution Act (FICA) and Medicare deduction for this period and year-to-date.

• UN Union Dues. L - National Association of Letter Carriers.

• IN Indicates your life insurance choice.

• ALOT Allotments. This is a recurring payroll deduction each pay period to a financial organization. The earnings statement will show A LOT and the dollar amount.

• C SUP or CS/SS This indicates child support or alimony payments.

• GARN This appears if you have a commercial garnishment levied against you.

• HP Followed by three (3) letters or numbers would show your health benefit plan enrollment code.

• LEVY Show a deduction has been made for some sort of outstanding taxes.

• TSP This indicates a withholding for the Thrift Savings Plan. If you participate in the plan, you will see either the percentage of withholdings or the dollar amount after the letter code.

• SOSEC This is the amount of Social Security deductions for this period and year-to date.

• TSPLG This indicates a recurring payment for a loan taken against the Thrift Savings Plan.

• FDV-D - Dental insurance. -V - Vision insurance.

• NET PAY This is what is left to pay your bills.

•

LEAVE STATUS

This is the general heading identifying your usage and balance of Annual and Sick leave, and Leave Without Pay for the pay period and year.

ANNUAL LEAVE

• FROM PREV YR This is the number of hours carried over from the previous year.

• EARNED - THIS YR This is the number of hours earned to date this leave year.

• EARNED - BAL This is the number of hours carried over from last year plus the hours earned this year.

• USED THIS - YR This is the total hours of annual leave used this year to date.

• USED THIS - PP This is the total hours of annual leave used in this pay period (including adjustments).

• BALANCE This is the total annual leave available to you now.

SICK LEAVE

• FROM PREV YR This is the number of hours carried over from last year.

• EARNED THIS YR This is the number of hours of sick leave accumulated this year.

• USED THIS - YR This is the total sick leave used to date this year.

• USED THIS - PP This is the total sick leave used this pay period (including adjustments).

• BALANCE This is the total sick leave available to you now.

•

LEAVE WITHOUT PAY

• THIS PP This is the total hours of LWOP used this pay period.

• CUMULATIVE This is the total LWOP hours accumulated this year. If you accumulate eighty (80) hours of LWOP within a year, your leave credits will be reduced by the amount of leave earned in one (1) pay period.

•

BOND DATA This identifies an employee's current bond(s), unapplied bond balance, and the bonds issued this pay period.

• UNAPPL BAL This is the amount applied towards the purchase of the next bond.

• NO ISSUED This is the number of bonds issued this pay period.

USPS RETIREMENT This is the total amount contributed to the retirement fund as of the close of the prior calendar year.

Other important codes are:

ADJ FOR PP-YR PROCESSED Shows that an adjustment for a specific pay period and year was processed.

GARNISHMENT PAYMENTS COMPL Shows the garnishment balance as zero (0).

GRIEVANCE OR EEO SETTLEMENT Self Explanatory

INCLUDES BOND REFUND Self Explanatory

MULTI PP ADJS PROCESSED Shows that adjustments for multiple pay periods were processed.

PERIODIC STEP INCREASE Self Explanatory

RETROACTIVE PAYMENT Shows this is a special check and Form 1223 for retroactive payment.

RETRO PAY IN YTD AMTS Shows that retroactive payment amounts have been added to the year-to-date totals.

SCHEDULED COLA INCREASE Shows that a cost-of-living increase has been added to the base salary effective with the pay period shown at the top of your stub.

SCHEDULED CONTRACTUAL INCREASE Shows that it is now reflected in the base salary.

UPDT YTD BAL CANCEL CHK An adjustment for a cancelled check was processed that updated the year-to-date earnings balance, affecting only the year-to-date fields.

UPDT YTD BK PAY AWD An adjustment for a back pay award was processed, affecting only the year-to-date fields.